There are some reliable indicators that the US 10 year economic expansion is coming to an end. If you are considering exiting your business, you should look at this closely.

One indicators is the flattening yield curve. A quick internet search will show you that many have written about it recently. The 3 month yield was higher than the 10 year yield recently, and it set off alarms.

From Investopedia: "A flattening yield curve may be a result of long-term interest rates falling more than short-term interest rates or short-term rates increasing more than long-term rates. A flat yield curve is typically an indication that investors and traders are worried about the macroeconomic outlook."

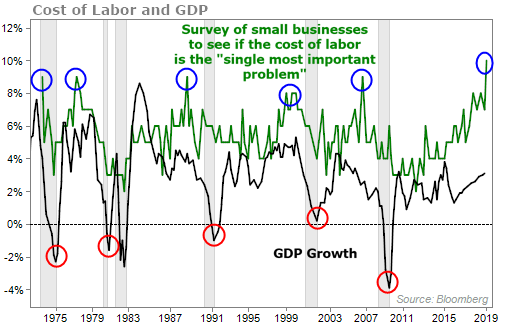

Another reliable indicator is the cost of labor. This chart compares recent survey results from the National Federation of Independent Business (NFIB) with GDP growth. The NFIB surveys 800 small businesses monthly about their most important business issue. When the most important problem overall is the cost of labor, that's historically a good indicator of a coming recession.

Typically a recession will follow around 12-24 months after the 2 year yield crosses the 10 year yield. A similar time frame exists when wages get high. Why do businesses care about the cost of labor? Because wages are the biggest driver of inflation. Subsequently, inflation is a major cause of a recession.

If you are considering transitioning your company, I wouldn't wait too long. Others are waiting too, and you want to beat the rush. Planning is needed to reach your transition goals.

Contact me to learn how you can make your business transition or exit soon!